People already take 2-3 credit cards membership to use in versatile places, as there are assorted credit card available in the market to choose from.

Some retail store chains provide credit cards to keep their ongoing customer base intact and attract new customers too by providing benefits, discounts, and perks.

Wawa retail company issued Wawa credit card for their customers especially to leverage some square up discounts from Wawa fuel.

Let’s dive into how you can log in, pay the bills, activate, customer support and other acknowledgements about Wawa credit card.

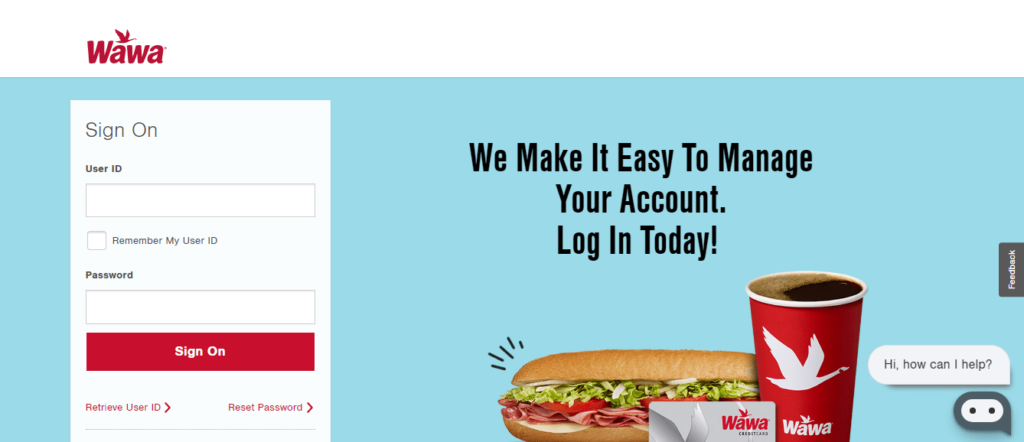

Login process for Wawa credit card:

Follow these steps to log in and access your Wawa card online:

- Go to the Wawa credit card login page.

- Then, enter your User ID or username, and password.

- Click “Sign On” and you can use it online.

Remarks: Make sure to tick the “Remember my User ID” which might save you some login attempts, and is quite useful if you have forgotten your password but want to use your account urgently.

Also, there are the most common options “reset password” and “retrieve user ID” available to resolve your login

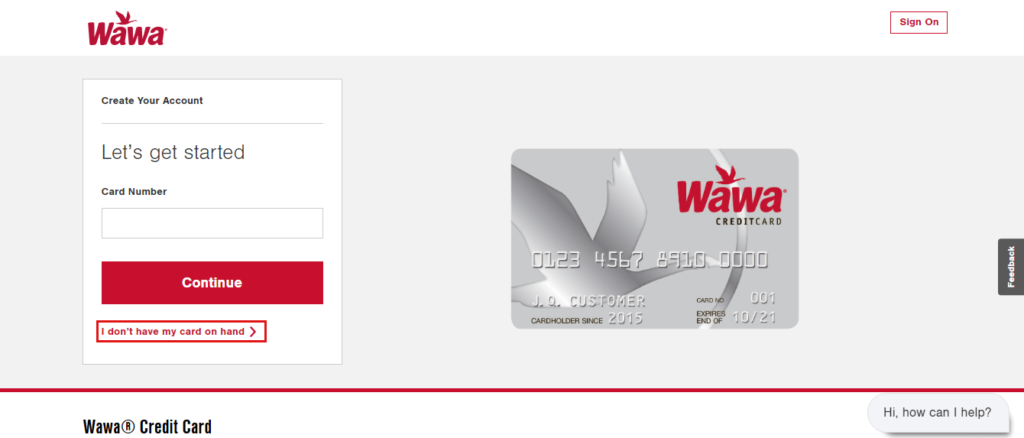

The absolute process to activate your Wawa credit card:

If you haven’t registered or activated your card online, then you might not be able to use it.

Here are the steps to complete your registration or activation:

- Revisit the Wawa card login page.

- Now, just click the “register your card” link.

- Enter your Wawa credit Card number and click “Continue.”

- Go through all the further steps to activate the card.

Activate the card by verification code:

- If you are a safety-minded person, you can also do the activation process, without providing a card number. Just choose the “I don’t have my card on hand” link, when on the credit card activation page.

- Provide the Cardholder’s name, and SSN, and verify yourself by getting OTP by text or email.

- Agree to the terms, and click “Send Code” to activate your card.

Payment Methods for Wawa Credit Card:

You can choose to pay your card bill online, by post, and through automated phone numbers, or you can visit the store to make a payment, it’s completely up to you, which way suits your preferences.

Pay Online: Look no further than this process if you want to complete the payment quickly, or are lazy enough not to drive yourself to make in-store payments, as it’s completely secure considering you don’t need to make payments physically or using paper currency.

Just log in to your Wawa account, which will be linked to your card once you activate it, and you can find a payment option under your account management tools menu.

Send payment by post: You can send the paper currency by post to their correspondence address, for the day and the overnight:

P.O. Box 9001101

Louisville, KY 40290-1101

Overnight Delivery/Express Payments

6716 Grade Lane

Building 9, Suite 910

Louisville, KY 40213

Pay using the customer assistance number: Several credit card issuers provide this option so that you can make payments without using paper money, even if you don’t have internet access. You need to call the company’s customer assistance number and validate your account details.

You can Call the 1-855-207-9816 number which is available 8:00 am – 10:00 pm Monday to Friday, 10:00 am – 8:30 pm on Saturday, and Sunday they are available 12:00 pm – 8:30 pm to get assistance.

Make in-store payment: If you want to be extra careful with your hard-earned money, you might pay by using the most conventional way, to visit the store and pay with peace of mind.

It could also be a good excuse to visit the Wawa store and look at other attractions.

Simple process to apply for the Wawa credit card:

Applying online is quite a convenient way to do so, as you don’t need to invest much of your time in providing documentation, filling out paper forms, etc.

Once you fill out all the essential details they might let you know within 30 days whether you qualify or not. If you wish to apply, follow these steps:

- Head over to the Wawa card login page, you visited in the “activating” and “log in” processes.

- Find the “not a cardholder?” text and click the “Apply now” link.

- You will see some essential terms and conditions links in text boxes, which you can read if you wish to. Then, Click “Get started” to proceed.

- Now give all the details they require, to apply.

- After providing all the details, and accepting the terms and conditions your application will be registered.

Wawa card: Customer Service Support

Contact by Phone: You can use +18554161988 number for any technical related issue and use 711 for telephone relay services.

Use +14234776612 to call from Puerto Rico, Canada, or outside the U.S.

If you want to report the lost or stolen card, use the 1-800-251-6781 number or 711 relay service to register your query.

Write them by mail: You can write any query to this correspondence address:

Wawa® Credit Card

PO Box 6139Sioux Falls,

SD 57117-6139

Ask them Online: You can seek help through the FAQs section for the Wawa credit card. However, If this doesn’t resolve your queries and you feel skeptical, then you can ask the question for yourself by More Info > Contact Us option in the footer section.

Benefits and crucial aspects of Wawa Credit Card:

Citibank, North America is the issuer of the Wawa®️ card as well as the curator of program attractions, and its terms & conditions.

Its services are provided and operated by Wawa Inc. which also holds complete rights of Wawa.

As a store card, its credit card can only be used under the roof of the Wawa convenience store company, it means you can use it in Wawa retail store, Wawa fuel ,etc.

You will reap in these benefits that are worth mentioning:

- You can save ¢50 per gallon on pump fuel for the first month and ¢5 per gallon thereafter, once your account is opened, and 10 points per dollar you spend on in-store purchases.

- zero liability protection.

- You can leverage pay at the pump facility at Wawa fuel station.

- You can access your card online at any time.

- If you wish you can pay only a minimum of the scheduled bill payment.

- Since it’s a credit card with a revolving account, you can pay the amount you used to use it again. (That might depend and vary following your credit limit.)

These are the crucial points you should grasp:

- The grace period is 25 days, and if you don’t pay the minimum scheduled amount in full amount, then you have to pay $2 interest with your primal amount.

- The APR is 34.24% which might shift in line with the market.

- Late payment fees and returned payment fees are $40 and $41 in order.

Better alternatives:

Well, it is quite a mediocre credit card apart from the benefits of 24/7 online access, making a minimum payment is enough, and zero liability charges.

If you want to look for a better alternative that earns you rewards as well as improves your credit score in the background, you can use it anywhere. You can have a look at these: