The Robinhood gold card even to this date is just a buzzword as it’s not set to come out yet; those who enrolled are still waiting to hold the card in hand.

The Coastal Community Bank is the issuer of the Robinhood gold card, while all the services are provided and operated by Robinhood Credit Inc. The issuer bank will report to the credit bureaus which will directly affect your credit score, and help you to elevate your creditworthiness.

However, it completely depends on the person, as responsible credit card usage is the key, and if not followed properly can result in the accumulation of debt. One must have to pay 1% of the credit limit to avoid any interest and late payment fees.

Since it’s pegged with a Visa license along with the 3% rewards in the form of 3 points per dollar, it might be something that could attract many people, as everyone borrows a credit card to establish a good credit score, but no one would ever neglect the opportunity to earn handy cash back.

Nevertheless, we are covering 5 crucial facts deeply that might be beneficial for you to know about:

1. Buying Gold Membership:

Although according to the internet, people are paying $5 per month or $50 per annum for the gold subscription needed for the Robinhood Gold Card, but, as I am writing it, there might be some alternations for new gold subscribers, according to the website they modified the fees to increase up to $6.99 for a month or $75 per annum in January 2024.

Therefore, you need to pay according to that fee criteria if you are looking to buy a golden subscription. Reportedly, you must check the fees using the Robinhood app, they added to the site.

Since all the benefits and perks are solely prioritized for gold members, those without it don’t stand a chance, however, the application is open for generic subscribers too, but it’s not certain that they will get approval, as they get the priority according to how much people are ahead before him.

Robinhood gives 30 30-day free trial, before the implementation of the fee, so that you can get the experience of the hospitality, and premium tools.

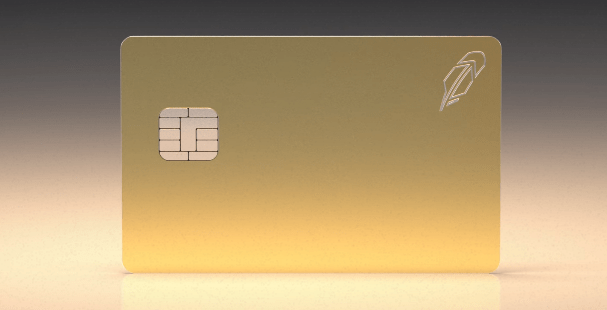

2. 10 Keret Gold Card:

Another point of interest is that you can get the limited-edition 36-gram card made with pure 10 Keret gold, which is possible only if you provide 10 referrals from your side.

Once you are on the waitlist, you need to bring 10 people to subscribe for the gold membership and enroll in the waitlist through the Robinhood app to increase your chance of achieving this special offering.

You need to be aware of not bypassing the terms and conditions of the program which include that the person should not carry the gold membership already, and must undergo the entire process so that you can earn the referral point and approach close to your mark.

3. You have to pay APR:

There is no annual and foreign transaction fee in play, but they applied APR, so that means you need to pay a monthly or annual membership fee along with the APR which is between 20.24% and 29.99% at the market primal rates.

The benefits and perks you get such as 3% rewards on almost every category, 5% earnings on travel bookings, 24-hour concierge, and many more are enough to make your deal cost-effective. So, if you have a good credit score of around 680 then this might be the best bet, as you can earn more than you pay through 3% cash back on almost all categories across the entire spectrum, although they have not clarified the categories properly on the website, so there might be some exceptions you could run-in to.

But, the fact is that when you redeem these points to make purchases, 1 point is identical to $0.01 which means if you have 1000 points to spend then they are equivalent to $10, which is applicable for purchases and bookings.

4. You can add more cardholders without age limit:

If there is someone from your family who is overlooked by banks when applying for a credit card, then there is an aid for that, you can request a card that they will pair up with your account, which might impose a fee according to their prudence.

Aside from that, credit limit setup, locking lost cards, and monitoring spending are additional benefits you have in the palm of your hand, it’s hard to say whether you can add less than an 18-year-old family member or not.

5. Disposable card number for advanced security:

The availability of a disposable card number adds an extra layer of security, as you are not using your actual card number, which would save your sensitive data from hackers, thieves, and cybercriminals.

These virtual cards are available to use online only, as you can not hold them in hand. So it’s impossible to use them for in-store purchases, but if you are paying online to different merchants at one time, you have assorted virtual card numbers that are akin to your account, but make your original card details inaccessible.

Substitutes of Robinhood card:

The more alluring Robinhood gold card looks, the superior benefits it provides, in lieu of membership fee and APR. But, it might not be the best option for some people, and if they want some alternative to that, the Mercury Rewards Visa Card is worth checking out.

It comes without any security deposit and annual fee, plus you can get it with your fair credit score to improve your credit score while earning rewards up to $10.

TJX Platinum Mastercard is another substitute you can get with a credit score of around 640, without any annual fee. Also if you purchase goods from TJX retail chain stores such as Sierra, TJMaxx, and Marshalls, you can earn up to 5% rewards along with 1 point from each dollar at gas stations, and other eligible places. It will bring you up to $20 in earnings.