Credit cards are a prevailing yet decrepit term, as they gained popularity almost two decades ago. However, fintech credit cards are on the trend. Incorporating traditional cards with MasterCard, Visa ensures enhanced security, and robustness.

Login to your credit card online can also be acknowledged as a fintech facility so that you can access your card from anywhere even if you don’t have it in your pocket.

Nevertheless, here we are discussing how to log in to Mission Lane Visa Credit Card.

But before that, let me give you a brief overview. Its service provider is Mission Lane LLC. The card encompasses all these features mentioned above since it’s a Visa card, and its issuer is Transportation Alliance Bank (TAB).

Mission Lane Visa Card Login Process

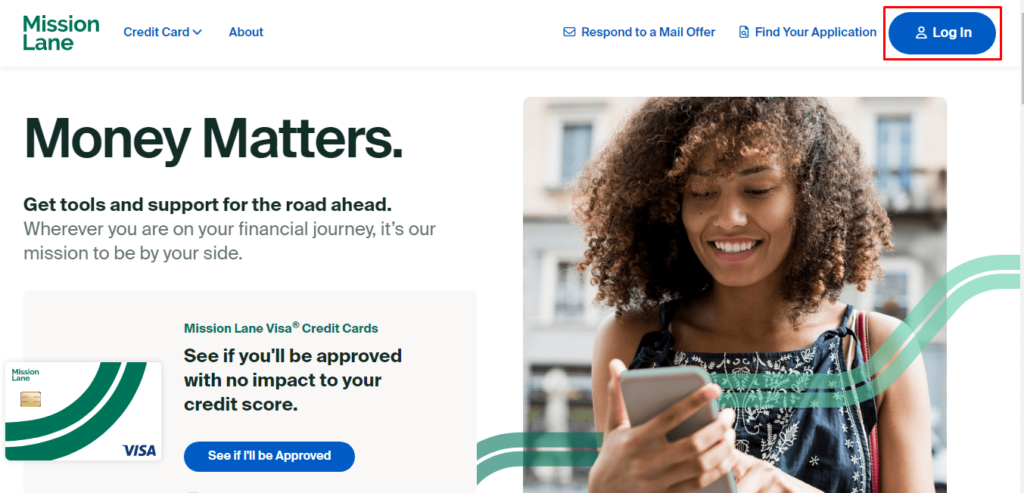

- First of all, visit the Mission credit card homepage.

- After that, hit the Log In button located at the top right corner.

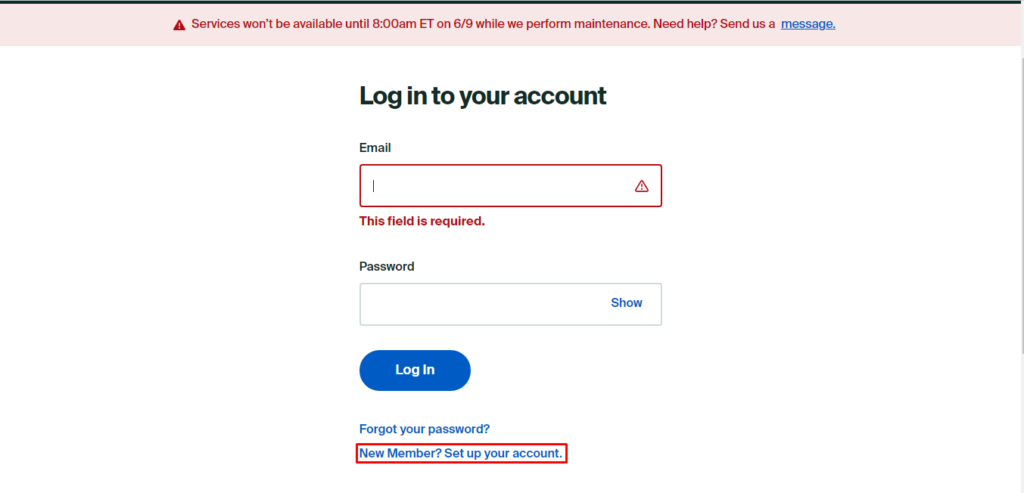

- The link will take you to the login page, where you need to input your e-mail ID and password. After that click the “Log In” button.

Note 1: The process to log in for this card is unlike the other credit cards, as you can’t log in through the issuer bank’s official site.

Note 2: Similar to the other login pages, you can reset your password here through the “Forgot Your Password?” link.

Activate Your Mission Lane Card

This is how you can activate your mission lane credit card:

Through Log In: You need to first set up your account, or log in to your mission lane account to perform the activation process. Which is through the “Activate” option.

By phone number: You can use the 855-307-1240 number to get help activating your credit card.

Contact customer Support

Customer Support phone number: You can use the number located on the back of your card to contact customer support. Customer service is available Monday to Friday from 9 am to 8 pm.

Also if you want to report a lost or stolen card grievance, call 1-855-790-8860.

Send a secure message: You can send your request to the Mission Lane Support page for any hardship or general request. However, this is not the fastest of all methods to get feedback.

Send correspondence mail: You can mail your concerns to this address:

Mission Lane LLC

PO Box 105286

Atlanta, GA

30348-5286

Register to Mission Lane

Follow the below-mentioned steps to set up your mission lane account:

- First, visit the login page link, by following the “log in” process.

- When on that login page, just click on the “New Member? Set up your account” link.

- After loading the link you need to enter your email address, date of birth, SSN, or ITIN. Then hit the “Find” button to complete the process.

Mission Lane Credit Card Approval Process

This process won’t affect your credit score, as you will not undergo a hard inquiry.

So, you need to follow these steps to check your pre-qualification:

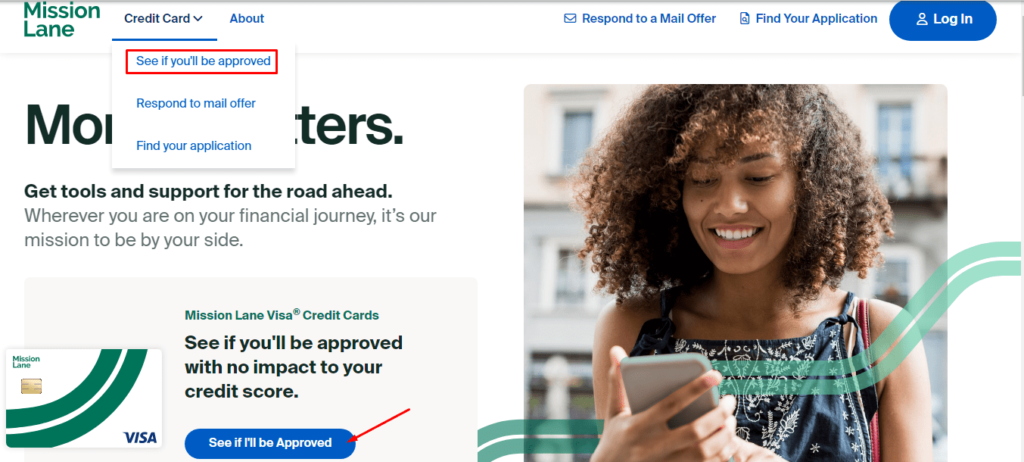

- Visit the Mission Lane credit card homepage again.

- Click on the “see if you’ll be approved” link.

- After loading the link, provide your personal, financial, and contact information, and agree to the terms by checking all the available boxes.

- At last, hit the blue button that says “See I’ll be Approved.

- According to the mission lane, you will likely get the answer within 60 seconds.

Respond—If You Pre-qualify

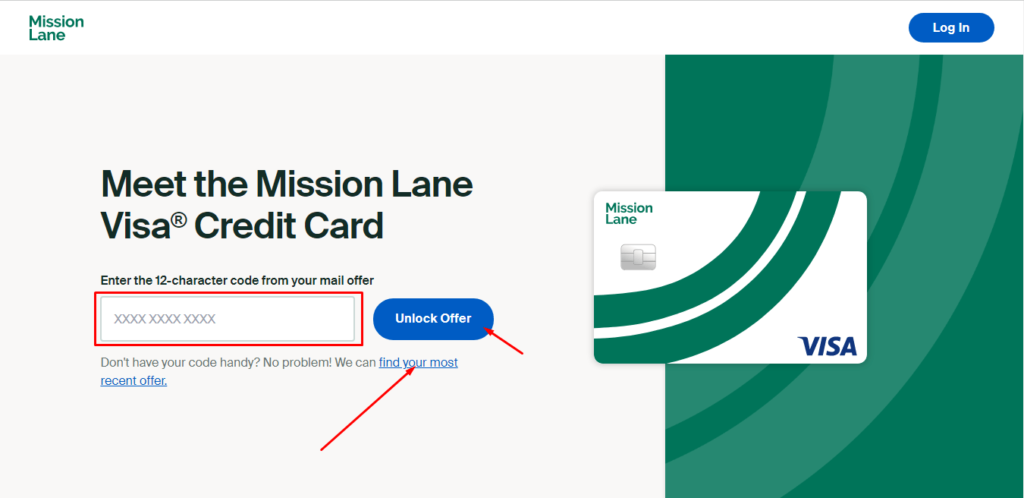

If you are someone with a 12-character code received from the issuer of the Mission Lane credit card, you probably meet their minimum eligibility criteria.

You need to provide them with a 12-character code, so they can acknowledge you as pre-qualified. Here is how you can do that:

- On the Mission Lane credit card homepage, click the “Respond to a mail offer” link on the top right.

- Provide the 12-character code you got through the mail, then hit “Unlock offer.”

- If you don’t happen to have the code, simply click the “find your most recent offer” link.

- Provide your first name, last name, zip code, and date of birth.

- Hit the blue button “find my recent offer” so, that they can verify whether you are on their qualification list or not.

You might like: GoMercury.com Pre Approved Application

Payment Options for This Card

Online: The most easy way to do so, is just logging in to your Mission Lane account, and you can locate the options that typically say “make a payment” or “pay your bill.”

By mail address: Send your cheque of payment with your name and 16-digit account number to this P.O. address:

Mission Lane LLC

PO Box 23075

Columbus, GA

31902-3075

Set-up AutoPay: Auto-pay gives the issuer the concurrence to debit the amount on the due date of each billing cycle, so you don’t need to worry about anything such as grace period, and last date.

This is how you can set or enable your AutoPay:

- First log in to Mission Lane account.

- You can find AutoPay under the “make payment” option.

- Now, you can set the amount, date, and the account from which you want to deduct the money, by following the instructions.

- You have now set up the AutoPay.

- If you having a hard time doing all that, you can call 1-855-790-8860 to ask for help.

Pay by Phone: The issuer of the credit card provides an automated number on the back of your card. So, you can use it for various tasks, such as processing your payment.

Benefits and Drawbacks of Mission Lane Credit Card

There are some benefits that could stimulate you to acquire a mission lane Visa card. But, there are also certain drawbacks to pay attention to.

Here you can acknowledge both of them.

Benefits:

- You can get approved even without any credit, which means it’s a good card for building credit.

- Your activity will be reported to all 3 major credit bureaus every month.

- $0 liability protection from Visa.

- You can request a credit limit increase after 7 months.

- No security deposit is required.

Drawbacks:

- The card does not earn you rewards.

- No startup bonuses and cash discounts.

Fee Criteria and Other Terms for This Card

- The APR for purchase and cash advances for this card is 19.99% – 33.99% and they are subject to change according to the market prime rate.

- The interest charge is $.50, which is quite considerably low.

- Late payment fee is set to $35 at max, while returned payment has an upper limit of $40.

- The annual fee is between $0 – $59. So, it’s up to your creditworthiness whether you have to pay an annual fee or not.

- Transaction fees for cash advances are $5 or 8%, while, foreign transaction fees are 3% for each transaction.

Frequently Asked Questions (FAQs)

There are three versions of the credit card that Mission Lane provides service for— Mission Lane Visa Card, Mission Lane Cash Back Visa Card, and Mission Lane Secured Card.

You can use the card for cash advances, and the fee for each transaction is either $5 or 8%. The greater amount from both is prioritized.

After your application is approved, you are likely to receive your card within 7-14 days (excluding holidays.)