Rewards credit card is one of the many versions of credit cards available in the market, that provides you rewards every time you use them to purchase something that is “eligible” according to the issuer’s rules.

However, if you look at the scenario of rewards through the aspect of store cards, then your rewards snagging is constrained, as that factor is cramped to the store the card is associated with.

Torrid credit card is also a reward credit card that earns you rewards. However, it’s not ubiquitous unlike the credit cards pegged with Visa and Mastercard licenses.

Before we talk about payment methods, let me briefly describe Torrid Credit Card. It’s issued by Comenity Capital Bank and is a brand of Torrid LLC. It’s an unsecured credit card—like the other store cards, You can only use it within those 5000+ torrid stores.

Here are all the methods to complete your Torrid Credit Card payments.

How to pay a Torrid Credit Card bill (Methods)

Store cards weigh heavily on finance charges such as APRs, annual fees, and interest rates. So, paying off your credit card bill on time is good practice to refrain from those terms.

Pay via Online

The most evident, and secure method, as you are going to directly pay to the issuer.

Follow this process to pay the credit card bill online:

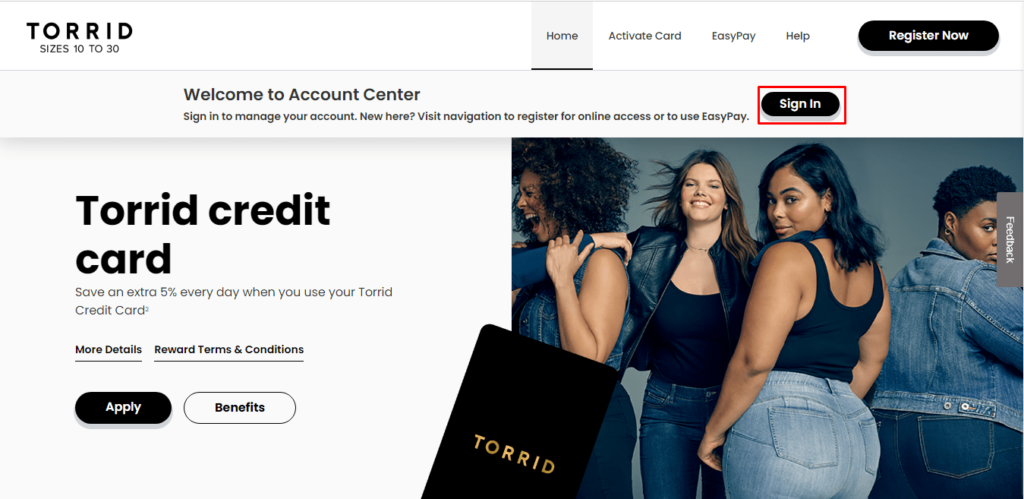

- Initially, visit the Comenity Torrid Credit Card page.

- Click the Sign In button.

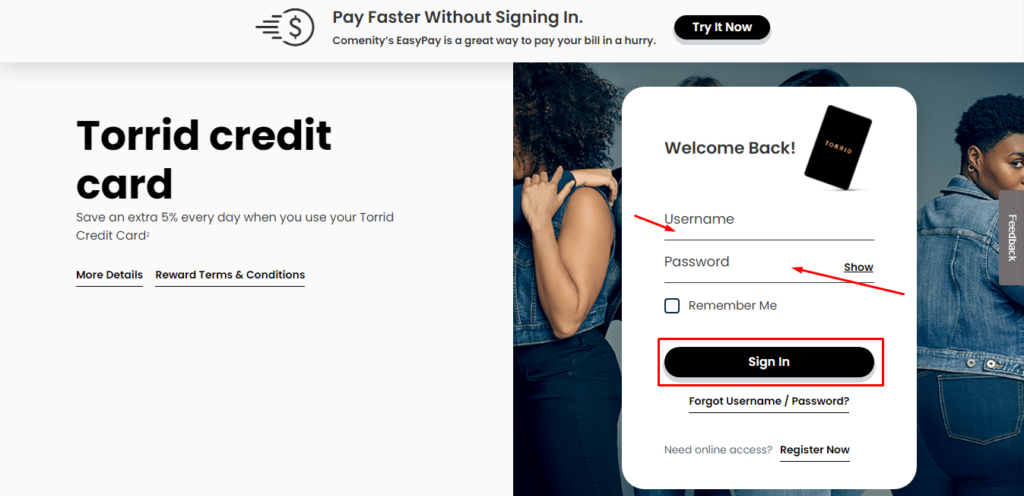

- Provide your username and password, then again hit the “Sign In” button, so that you have access to your credit card account.

- Now, you can find the payment-related option under your profile dashboard to complete your payments.

- For your help, there are options such as the “Remember Me” box, and the “Forgot username/password?” link.

- Note that you can consider this process to access your credit card online, which is acknowledged as Sign In or Log In.

Note that the “Remember Me” option can autofill your credentials when you try to Sign In to your account. But, for your security, Comenity Bank requests you to change your password every 7 days, and you should use this option from a personal network rather than the public or unsecured network.

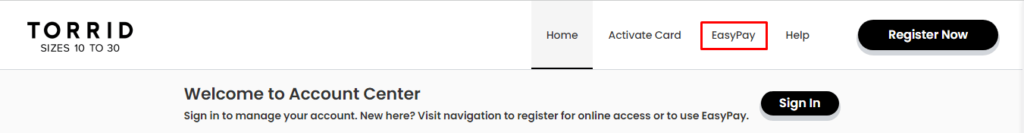

EasyPay—Pay without login:

This option lets you pay much more quickly without any hardship, as you don’t even need to log into your credit card account for that.

Just follow these simple steps to pay off your card’s bill through this option:

- When on the Torrid card Sign-in page, click the EasyPay tab from the top menu.

- Now when the EasyPay form opens, fill out your credit card account number, zip or postal code, choose the identification type you have, and provide that identification number accordingly.

- Then Hit the “Find My Account” button.

Pay by Phone number:

You can call 1-800-853-2921 to process your payment through phone.

Torrid Credit Card Payment Address

You can mail the payment to this address:

Comenity Bank

P.O. Box 650960

Dallas, TX, 75265-0960

Pay via the Torrid Mobile App

Once you have set up your credit card account, you can use the mobile app to complete your credit card payments. More elaborately, you can do pretty much everything that you can do through the website.

Ways to Reach Out Customer Support

By Phone: Call the assistance number 1-800-853-2921 (TDD/TTY number is 1-800-695-1788) to contact the support team for any kind of query. Help is available 8 am to 9 pm, Monday-Saturday.

Send Mails to P.O.: You can post your mail to this address for any concerns:

Comenity Bank

PO Box 182273

Columbus, OH, 43218-2273

Send Secure Message: If you have registered your card, you can log in to your card account and send a secure message to Comenity Bank regarding any specific topic.

Torrid Credit Card: Apply

Before applying for the card, check out the “benefits”, “drawbacks”, and “fees and terms” from this article.

Adhere to these steps to apply for the Torrid card:

- Head over to the Torrid credit card customer care page.

- Scroll down a bit to find a big black button that says “Apply Today.”

- A pop-up screen will appear, showing you the benefits and other terms of the card, which if you want you can read carefully.

- Now, click the red “Apply” button. There could potentially be a security authentication, so after clearing it, provide all the required personal, contact, and financial information, and agree to the terms to apply.

Register or Set Up Your Account

Here’s how you can register your credit card account:

- When on the Comenity Bank’s torrid card homepage, click that big black “Register Now” button located at the top right corner.

- Now, provide your credit card account number, and zip or postal code, and at last choose the identification type you have and provide its number.

- Click “continue” to take the process further, provide all required details, and follow the instructions carefully in the subsequent process.

Activate your card:

There are two ways to do that—through the Online process, and by phone number.

- Visit the Comenity Torrid Credit Card Sign-In page, and click the “Activate Card” tab from the top menu.

- Provide the credit card account number, and its expiration date, and choose the identification type you have, provide the identification number, and Zip code or postal code.

- Then click the “Continue” button.

- You can also activate the card using the 1-800-853-2921 number.

Card Benefits:

- 40% off on your eligible purchase from torrid.com straightaway.

- 5% off every day when using the torrid card.

- When you spend $50 on your very first purchase by credit card, you’ll get a $15 discount.

- Exclusive deals and offers.

- No annual fee.

A Few Drawbacks:

- Since it’s a store card, you are quite limited to using it within torrid stores.

- High interest rates, APRs.

- You have to be a member of the Torrid Rewards Store Loyalty Program in order to earn rewards.

- Even as a cardholder, you will not earn more than 1 point for every $1 expenditure.

Fees and Terms to Consider:

- Annual Percentage Rate: The ongoing APR for purchases for this card is 35.99%, which might vary according to the market’s prime rate.

- Interest: The minimum interest for the card is $3.

- Late Payment and Returned Payment Fees: They both start from $30 and are capped at $41 adhering to the law.

- Statement Fee: They also charge you some dollars per month to mail the paper statements to your home. The ongoing charge for this facility is up to $35.88/annum. However, you can eradicate yourselves, if you opt-in for paperless statements through your account or the Torrid app.

- Eligibility: Similar to other cards, you also need to be 18+ to apply for this credit card.

FAQs

1. What bank issues torrid credit cards?

Comenity Capital Bank who is adjuvant of Bread Financial, issues the Torrid credit card, and the servicer of Torrid card accounts.

2. Is it hard to get a Torrid credit card?

Store cards typically don’t have a high demand of credit score, if you fall around to a fair credit score with a responsive credit history, there should not be any trouble to acquire one.

3. How do I pay Torrid’s Credit Card bill?

There are many ways to do so—Online, by phone, sending payment by post mail, and enabling the AutoPay option.

The fastest way to pay off your credit card bill is by calling the 1-800-853-2921 number. Also, you can enable the AutoPay option which automatically deducts money from your account by the due date.

You might like: the Wawa credit card login guide