Mercury credit cards are one of the bona fide credit cards in the U.S., with more than 1.5 million cardholders. Mercury Financial is running the 24th biggest Visa/Mastercard program in the U.S.

Mercury company which once was gomercury.com is now transformed into www.mercurycards.com, which is much more straightforward in its purpose.

First Bank & Trust, Brookings, SD (South Dakota) is the issuer of this Mercury Rewards Visa Card ®, and Mercury ®️ Financial operates the credit card and controls three more credit cards additionally, such as NEA Mercury Mastercard, SEIU Mercury Mastercard, and Free Spirit Points Mastercard.

Mercury®️ Rewards Visa®️ Card:

The Mercury Rewards Visa card comes under the Visa ® license, and the latter credit cards come under the Mastercard ® ️license, which isn’t unknown to anyone on this date.

Mercury’s Rewards Visa Card ®️ is a flagship card under the Visa license, which means you can use it anywhere credit cards are accepted to pay any kind of bills e.g., gas stations, restaurants, retail stores, grocery, etc.

When you shop from the card you make yourselves eligible to earn rewards points, which you can get in the form of a penny.

Mercury Rewards Card: Benefits

- You can use it in plenty of places.

- You are not obligated to pay any security deposit.

- It can come in pretty handy to increase or build your credit score.

- Even low credit score holders can get it.

- You can use it for cash advances, payments, and balance transfers.

- You have access to the FICO score check for free.

- You are not at fault if any unauthorized transaction appears from a lost or stolen card of yours.

- You can get your credit limit started around $1000-$1100.

- It comes without any annual fee.

- You get 1 point for each dollar on approved purchases or valid bill payments. (Which concludes returned payments, disagreed fees, illegitimate charges, etc.)

- If your application is approved, you are likely to receive your card in 7 days, and 10 days at max.

- You can get the reward point benefit of a whole dollar even if you spend less than a dollar but not less than $.50. For instance if you spend $9.50 they will increase to $10 to get 10 reward points.

Few things to consider:

- You can only have a small part of the credit line to use for cash advances.

- Purchases APR (Annual Percentage Rate) is 29.99% to start with. Which might vary from 29.99% to 32.99%, called Variable APR which might increase or decrease by the Prime Rate, which addresses the calendar month it changes in.

- Balance transfer and cash advances APRs also serve the same percentage of 29.99% and it varies to 32.99%.

- Your billing period is 28-33 days.

- After the end of your billing period, you need to make the entire card payment within 23 days to avoid any interest fee.

- They will start to apply interest on cash advances, and balance transfers from the date of money exchange.

- Primal interest charge is $0.50.

- “Late payment”, and “Returned payment fees” are $41, while if a check is returned from your bank, then the fee is $25.

- They frequently report to credit bureaus to scrutinize your credibility. As per your request, they could provide you the name of the agency of the credit report provider, and in case you find anything mentioned in a wrong way, you can write your name, address, phone number, and account number to their corresponding address for the mistake: Card Services, PO Box 84064 Columbus, GA 31908.

- If you request a lost or stolen card quick delivery, they charge you $25 as an expedited fee.

Points and Rewards:

- You can utilize the points once they get to 1000.

- Each time you get to 1000 points, you can use them for a $10 reward.

- After 1000 points, you must achieve points in the addition of 100 to encash them. For instance, if you have 1050 points, you can only redeem them once they get to 1100 and it continues to work like that.

- You can not do anything about the already redeemed points.

- The managing company and the bank have the right to change the program in any way or cancel it, without any official notice.

- Once you redeem the statement credits tend to take around 7 days to process.

- You might get bonus points as “special offers.

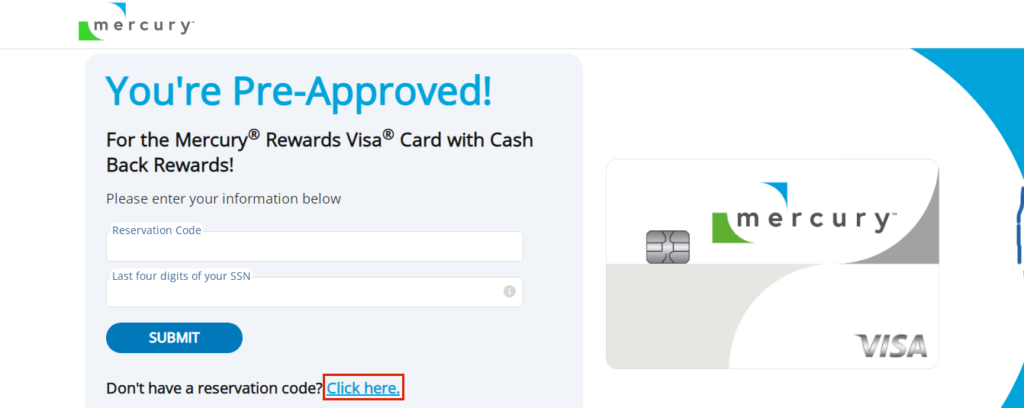

Gomercury.com via pre-approved application process:

Mercury reviews your credit history, and records. And based on your eligibility you might get a mail from them which is called a “pre-approved offer.” It contains a reservation code, which you enter to provide an application.

If you received this kind of mail, that means you are now eligible to get a Mercury Rewards Visa Card, and from here you can follow the steps below to complete the application process:

- Visit the Activate Mercury Rewards Visa Card page.

- Enter the “Reservation Code”, and” Social Security Number”, and click “Submit.”

- After some easy process of confirmation, verification, agreement to terms and conditions, and approval of your application, you are all set to get the card.

If you aren’t pre-reserved, then follow these steps to get a Reservation Code:

This means, you either don’t meet their criteria or you can check eligibility for the card, and for that follow these steps:

- Head over to the above “Activate Mercury Rewards Visa Card” link again.

- Tap on the “click here” link, below the submit button.

- Now, enter all the required details to proceed.

- Now, you can get a reservation code if you meet the standard criteria.

Remark: you can also download the Mercury Cards app from the Google Play Store or from the App Store, to manage your credit cards on the go.

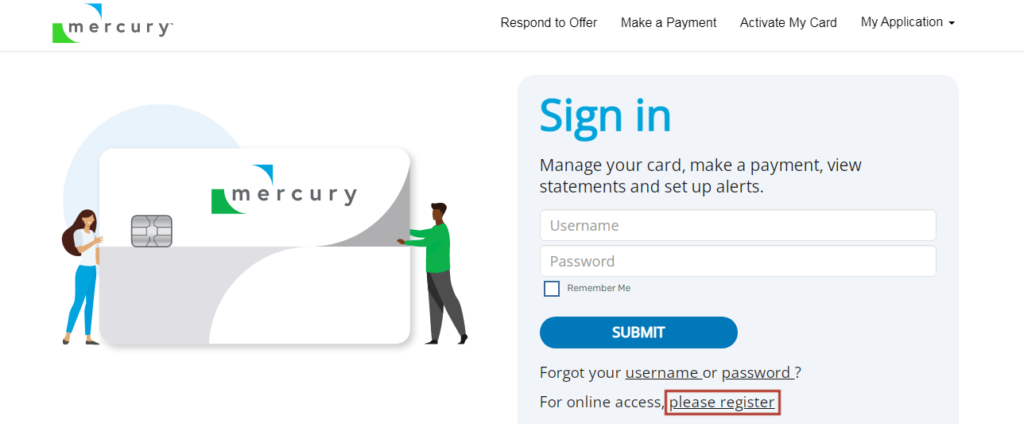

Log in to your Mercury credit card:

- Visit the Mercury Cards website.

- Enter your User ID, and password, and click “Submit.”

- Now that you have access to your account alongside your Mercury Rewards Visa card. So, you can do various account-related actions.

Steps to follow for online registration of the card:

- Visit the link, you visited when you did in the “log in to your account “section again, and select the “please register” link.

- Now, under the “Register online access” heading, enter your card number account number, and other required details, and tap on the “proceed” button.

- Now, as you know, you might need to verify some of the information you just gave in further steps. So that they can acknowledge you.

- After, this process you can make yourself login credentials to access the credit card online.

If you have problems following this process to register, then you can click “don’t have account number” Then you just need to provide your last name, SSN, and date of birth to gain access.

Mercury card: Bill Pay

- Online: Visit the Mercury credit card official site, find the “Make a payment” option under the Menu bar, and enter the required credentials to pay your credit card bill online.

You can choose to pay via debit card by logging in to the mercurycards.com website which is the fastest way of all.

or call the number located on the back side of the credit card and pay via bank account.

- Via Mercury Cards App: You can also pay the bill by using their app, by just following the same process as you did in the online payment option.

- Enroll in AutoPay Method: This option is available under your accounts section when you log in to your credit card, this could come in handy to avoid any late fee. You can choose or cancel this process, before the 3 days of the due date.

- Mail the payment: This is probably the slowest and oldest way to pay the credit card bill.

However, you can mail them to the following correspondence address:

Card Services

PO Box 70168

Philadelphia, PA 19176-0168

You can opt to pay the bill at the address which is only available for overnight payments:

Lockbox Services

Box #70168

400 White Clay Center Dr

Newark, DE 19711

Mercury Customer Support Options:

- Regarding the queries or getting information about privacy and security or to utilize them, you can contact them at 1-877-677-0982 phone number, or e-mail them to Partnerships@MercuryFinancial.com.

- You can contact 833-766-4844 to get support related to online or mobile apps, or for submitting a new application.

- Contact them through correspondence:

Card Services, PO Box 84064, Columbus GA 31908.

- You can get 24-hour customer support regarding the payments section at 866-686-2158. And for international concerns, call at +1-706-494-5025.