Shopping for home decor sounds fun and quite hustling similarly. But it’ll be convenient if you get all kinds of home-related stuff, such as electronics, home furnishings, etc, at one stop.

Recently, retail stores have become convenient and favorite choices for customers, where you get all your essential goods in one place, with handsome savings in bulk purchases. Also, you get an online shopping option so you can shop without stepping out of your house, along with the facility to get your order delivered to your home, where you can pay for delivery.

BrandSource could be your one-stop shop to get all this stuff, as they have 4,500 in the U.S. to provide you with the best home decor products.

But, the primary concept is purchasing all your home decor stuff through their private Credit Card, which they issued in union with CitiBank, which is helpful in purchases of all the things you need, alongside additional benefits. So, Let’s focus on the heart of the matter.

BrandSource Credit Card Overview:

BrandSource’s Privately owned and CitiBank-issued credit card can help you purchase goods and materials related to your home but is limited to the Brandsource empire.

With a network of approximately 4,500 stores in the U.S., it eliminates all the ifs and buts to make purchases.

Additionally, the benefits you get by using its Credit Card for purchases can bring you better discounts.

Benefits you can get from the Card:

- Affordable financing options are available so that you can get the flexibility and peace of mind to shop without worrying about the payment of the Card promptly.

- You’ll get their curated Promotional reduction incentives for the purchases, which could come in the form of either differed interest promotional offers or promotional APR on specific purchases.

- Zero liability charge in case of any unauthorized transaction from your account.

- It comes with a credit line focused on home-related goods.

- All with no annual fee.

Things to know before applying for the Card:

- The credit card is only for U.S. residents.

- Once your application is accepted, it might take up to 14 days for you to receive your Card; they’ll instantly reply in most cases, but in case of any delay, they’ll inform you through U.S. mail regarding your application within 30 days.

- Remember that the APR is 29.99% for variable and non-variable both, so keep this in mind before applying to stave off any inconvenience.

- It would help to be 18+ to apply, and in the case of Puerto Rico, the minimum age is 21.

- The charge is $2 in interest if you don’t pay your credit cycle bill even after 25 days from the due date.

- Late payment fees are up to $41, and for the returned payment, where your bank denies the payment request, the initial charge is $30 for the first returned payment: in case of continuous request denial, the charge will go to $41.

- They reserve all the rights to gather all kinds of fiscal data to determine your credit limit.

- They decide your credit limit through your account record or other financial documents, plus you need to meet at least the standard credit score to apply.

How to log in to the BrandSource cardholder account:

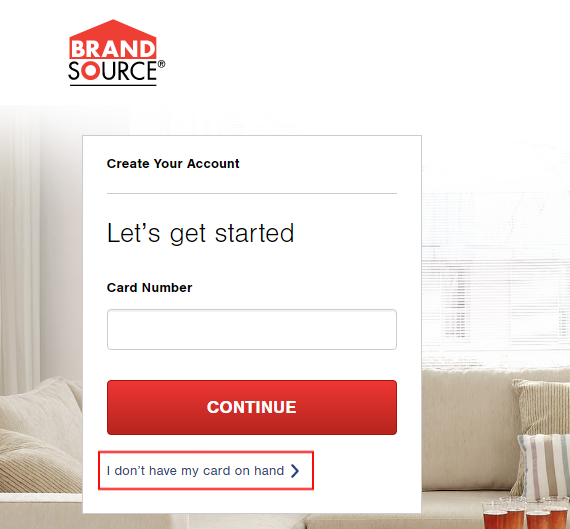

- First, You must register your Card to access your cardholder account. And for that, visit the BrandSource Credit Card Account Creation Page.

- Enter your “credit card number” and click “Continue” to register your Card. You might need to give personal details such as your name, address, date of birth, and Social Security Number for verification.

- You might need to go through the verification process.

- When the verification process finishes, you might get a confirmation mail, after which you can set up your cardholder account.

- If you don’t have the Card now, click the “I don’t have my card on hand” link below the “Continue” button.

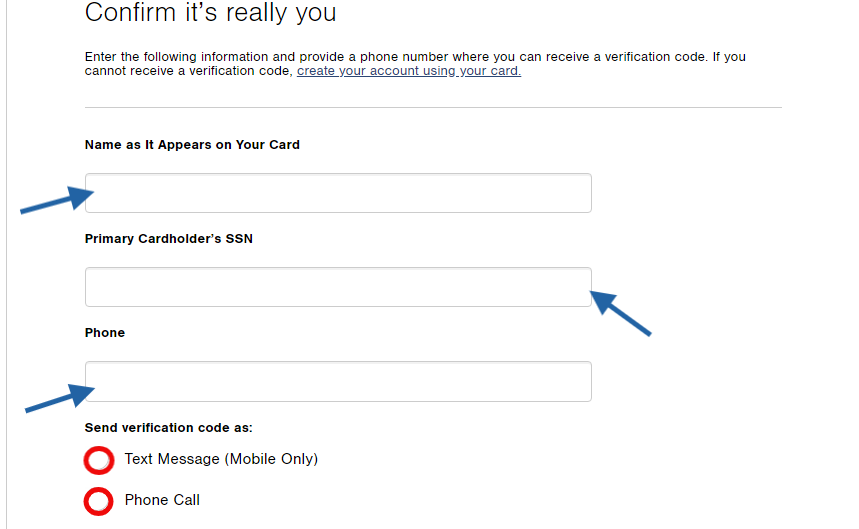

- Fill out the name on the Card, the Cardholder’s SSN, and Phone number, choose the option from a phone call or text message to receive the verification code, tick the box, and click “Send Code” to get verified.

Now, you can set up your User ID and password to access your Card online. For that, follow these simple steps:

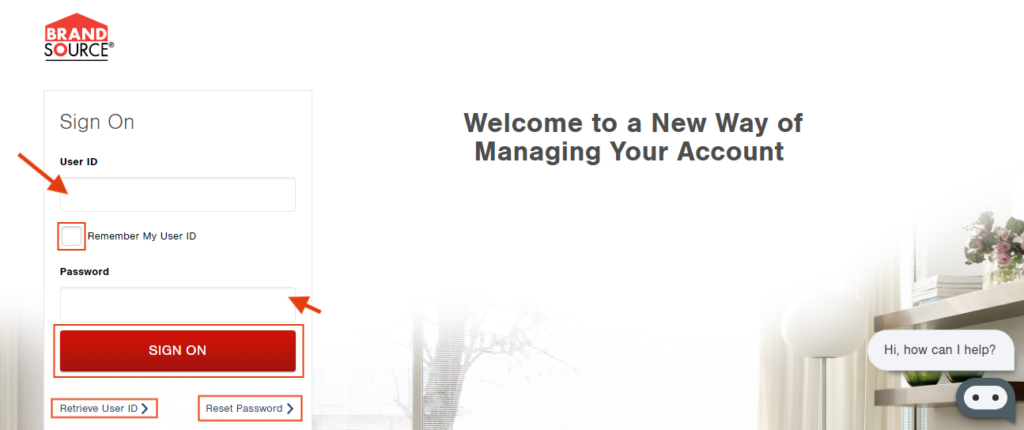

- First, Go to the BrandSource Credit Card Login Page.

- Input your User ID and password that you can make after completing the verification process.

- Click “Sign On” to access your account. (Now you can access or log in to your cardholder account.)

- You can recover the user ID and reset your password if you lost or forgot either by clicking the “Retrieve user ID” or “Reset your password” link.

How to apply for the Brandsource Credit Card:

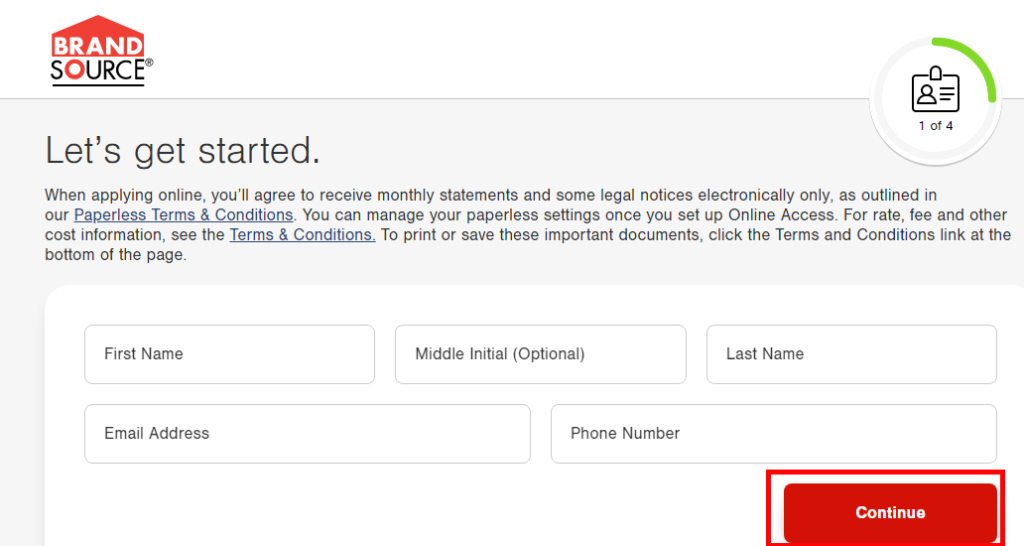

- Initially, visit the BrandSource Credit Card Online Apply Page link.

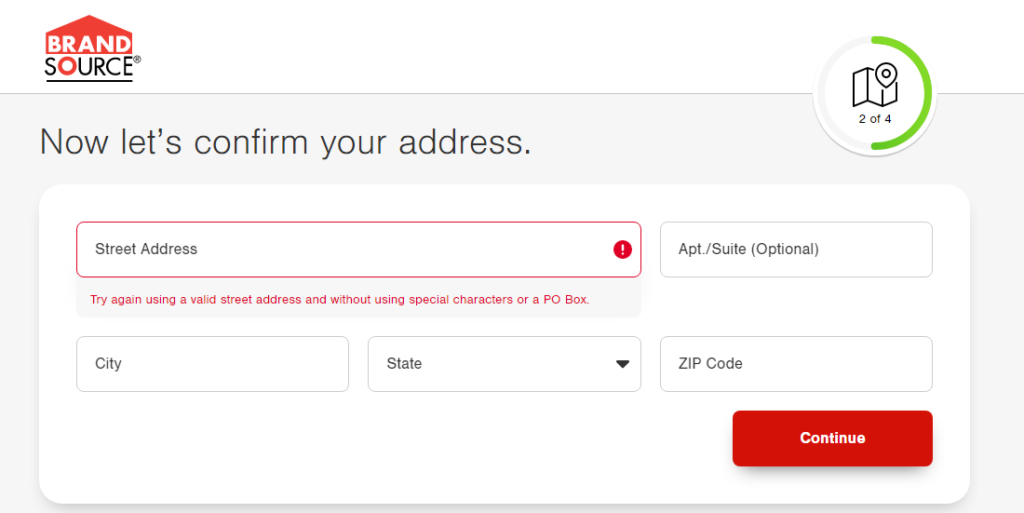

- Fill out your details as shown in the image. After that, click “Continue” for the next step.

- In the next step, enter your street address, city, zip code, etc, then click “Continue.”

- There are two more steps to complete for your BrandSource credit card, so please follow and fill out the essential information to apply.

To apply offline or in-store: You can also apply by visiting the nearest BrandSource store to apply for the Card. Make sure to read all the terms and conditions before proceeding.

Payment methods to pay your credit card bill:

Online: You can pay your bill directly by accessing your credit card account on the BrandSource website.

Offline: You can visit your nearest BrandSource retail store to make payments in cash.

Through Phone: You can contact them at 1-888-653-4320, Monday-Friday.

Through Post: You can mail with cash to their correspondence address-

Brand Source® Credit Card Payments

P.O. Box 9001006

Louisville, KY 40290-1006

Customer Service

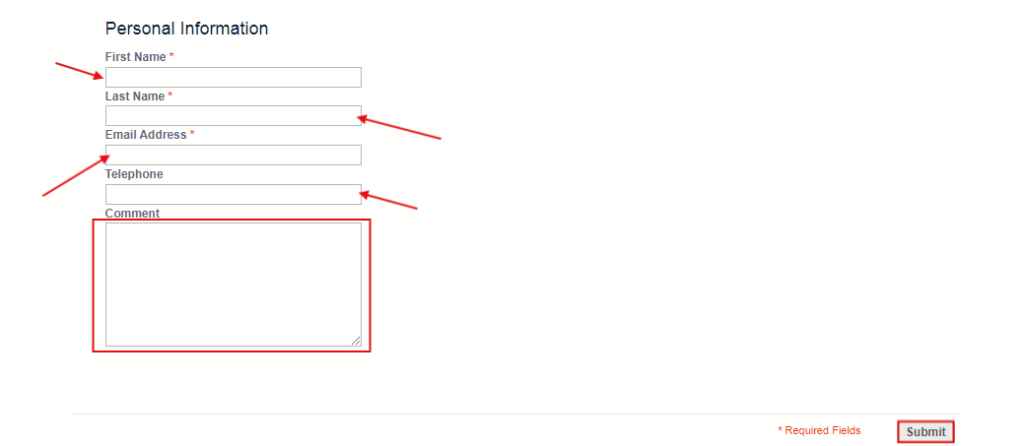

Visit https://www.brandsource.com/contacts for online support. Fill out the required fields with the question and click “Submit.”

Phone numbers:

1-888-653-4320, Monday-Friday

For Technical Assistance:

1-888-653-7614

For TTY: Use 711 or other Relay Service

Outside the U.S., Canada, and Puerto Rico, Call Collect

1-423-477-6512

Physical address:

Brand Source® Credit Card

P.O. Box 6403

Sioux Falls, SD 57117-6403

BrandSource Credit Card

Attn: Consumer Payment Dept.

6716 Grade Lane

Building 9, Suite 910

Louisville, KY 40213

Frequently Asked Questions (FAQs)

1. What is the BrandSource credit card?

BrandSouce retail store issued this Card through CitiBank to provide the convenience of buying all their private home decor products without instant payments, alongside additional benefits.

2. What are the benefits of a BrandSouce credit card?

- Affordable financing options.

- Promotional discounts.

- Zero liability fees.

- A credit line only for purchasing home-related goods.

- Zero annual fee.

3. What are the key terms to remember before applying for the Credit card?

- Credit Card is only for U.S. residents.

- After the approval of your application, you can get your credit card within 14 days.

- The variable and non-variable APR is 29.99%.

- It should help to be 18 or above to apply for the Card, and in the case of Puerto Rico, the minimum age is 21.

- The interest charge is a minimum of $2.

4. What are the payment methods for the BrandSource credit card bill?

- Online: You can pay your bill directly by accessing your credit card account on the BrandSource website.

- Offline: You can visit your nearest BrandSource retail store to make payments in cash.

- Through Phone: You can contact them at 1-888-653-4320, Monday-Friday.

- Through Post: You can mail with cash to their correspondence address.

5. What is the login process for a BrandSource credit card?

Once you have registered your BrandSource credit Card and get your Username ID and password, you can follow this simple process to log in:

- First, Head over to the BrandSource Credit Card Login Page.

- Input your User ID and password that you can make after completing the verification process.

- Click “Sign On” to access your account. (Now you can access or log in to your cardholder account.)

- You can recover the user ID and reset your password if you lost or forgot either by clicking the “Retrieve user ID” or “Reset your password” link.

6. How can I contact the support team for BrandSource?

- Visit https://www.brandsource.com/contacts for online support. Fill out the required fields with the question and click “Submit.”

- Contact them by phone at these numbers:

- Or you can mail to their correspondence address for payments and other topics.