Store credit cards can be a good source to earn handsome rewards if you are connected with a particular retail chain company, and love its products. Having its credit card can help you shop in bulk with discounts, and your credit score keeps getting better alongside.

As a customer, you have the satisfaction that you are not using your own money from the bank account, but instead using an external account linked to a credit card to complete your payment, which does not affect the money in your checking account.

And, as a business, if you manage to provide reasonable rewards and services through the credit card, you bind your old customers and create an opportunity to bring new customers through them.

Wawa Credit card Overview

The issuer of the Wawa credit card is Citibank, North America and it is serviced by Wawa Credit Inc. The issuer bank will report to credit bureaus constantly, to help improve your credit score.

As a store card, it does not give much to redeem, since it only gives you pay at the pump facility along with ¢50 per gallon savings for the first month, and ¢5 per gallon afterward, which sounds titular to me.

Anyways, here we are talking about 5 important facts that tell you if it is worth carrying a Wawa card or not.

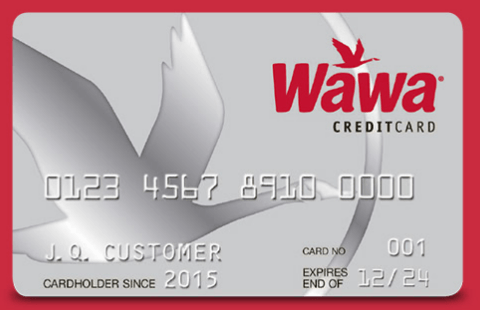

1. It looks alluring in platinum like color:

Before we dive into the internal part of the article such as services, rewards, fees kind of stuffs, let’s take a while to appreciate its looks. The platinum kind of color gives me a royal, premium, and enthralling vibe, so at least it will throw a quality impression on the others.

Image does not justify the style, and vividness it carries, but surely a physical version going to do so. It would surely improve your credit score, to say the least, however, these two terms are not adequate to borrow a Wawa card, and it’s going to be evident below.

2. You are not going to extract much from it:

Put simply, the card will not give you anything apart from that ¢50 off per gallon for the first month, ( that too is only valid until the end of 2024.), and ¢5 per gallon rest of the card’s life.

However, if you do not enjoy being in the waiting queue, pay at the pump facility saves you to do so, as you just swipe or tap to pay, fill your tank, and drive away by saving some pennies altogether.

It will not be a huge reward or discount, as you need to buy a couple of gallons to save yourself a dollar, when it comes to the very first month, and after that 20-gallon fuel will earn you $1. While, you deserve a little better than this as a card user.

However, if the pump you are at, is not in participation with Wawa company, you are not even going to save those pennies, instead, you need to pay with cash unless you have another credit card that is acceptable at gasoline pumps.

3. It’s a Revolving credit account:

A revolving account lets you use the set credit limit again and again if you pay your unpaid amount in full. Besides, you also have the flexibility to make minimum payments in every billing Cycle.

However, it’s a good practice to pay your balance in full, as carrying the pending balance for next month will burden additional interest on you, in forms of APRs.

If they approve your application the minimum credit limit you are going to get is $200, and after that, it will completely rely on your creditworthiness.

So it’s better to expense according to your requirements and your capabilities even if you get a higher credit. Therefore it’s the only strategy that will work in all circumstances no matter what credit card you own.

And, if you over limit your credit line, you still need to pay the balance either in full or a minimum amount, this could provide you some flexibility if you accidentally cross the credit limit.

However, this circumstance could pose a threat to your credit score, as the issuer might impose an over limit charge.

And as the Wawa says in agreement that you are not allowed to go over your credit limit, consider this as a warning that they are independent to take further steps according to their own discretion.

4. Some facts are still prone to your side:

Lack of annual fees and other fees such as foreign transaction fees, and cash advance fees, are the only things that sound appealing.

Considering other aspects, it’s better to be forgetful about this card and find better alternatives even after staving off these costs. You need to find an excuse to carry a Wawa credit card.

Additionally, the advantage of getting additional cards at no cost can be beneficial to you as you can authorize your family members to have a similar Wawa credit card.

You can fuel up their vehicle from a fuel merchant linked with Wawa company, and the bill will be added to your statement bill. And you can keep an eye on bill expenses from your family, and also earn some cents as cash-back.

Although this would feel to load up more cost, and could drive you to increase your credit limit.

5. You can look for better alternatives:

There are some particular categories of cards you can seek. However, if you do not exactly want a store card, and want to play safe, you can consider having a Credit One Bank’s Secured Visa Card.

Credit One card requires a certain amount of deposit as a security amount, and becomes your primary credit line to help you boost your credit score.

Also, it’s a good option for those with poor credit scores, and who want to earn some interest. It pays back when you close your account without any remaining payments, or switch to an unsecured card.

Anyway, If you are looking for a specific store card, you can switch the Wawa credit card with the TJX Rewards Store Card for a 10% discount on your very first purchase from TJX stores, and 5 points for each dollar spent whether you shop in-store or online.

It has no annual fee and anyone with a low credit score holders can easily qualify for that. Also, for 1000 points, they give $10, where $20 is a maximum reward.