Is your credit score on the verge of descending to a level of ineligibility for any help? Credit cards play a crucial role in boosting your credit score so you can get all the benefits you are missing. They offer some extra perks, and your credit score keeps improving in the background, Concealed from your awareness.

Merrick Credit Card is the card that Merrick Bank issues. They are one of the top 20 credit card providers in the U.S. in improving or taking your credit score at the peak.

If your goal is to increase or improve your credit score, this is one of the cards you can get even if you have a credit score just above 600. There are two segregate cards of Merrick Bank.

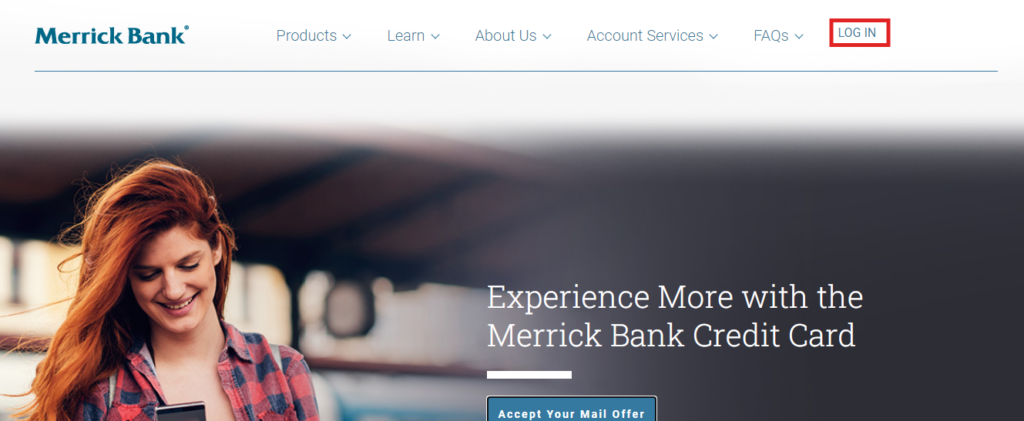

Merrick Bank Credit Card Login Process:

- Visit the Merrick Bank official site.

- Hit the three-line button for Android users, or hover over the “Log In” button to proceed.

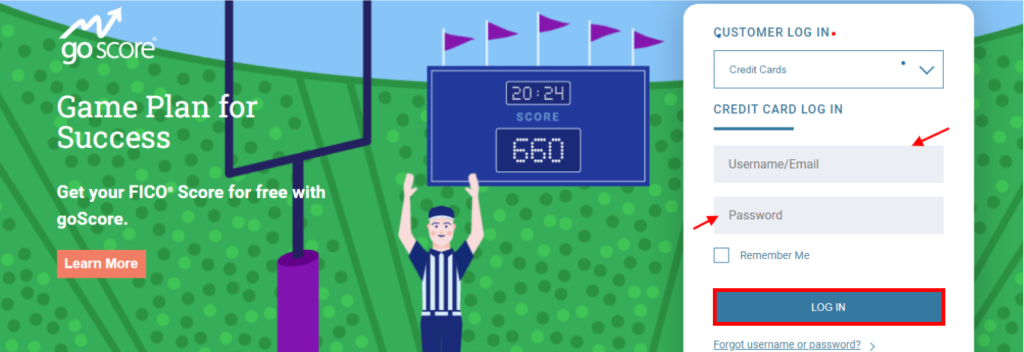

- In the newly opened page, “Credit Card” is selected by default in a drop-down list under the “Customer login” text. So you don’t need to worry about that.

- Fill out your e-mail and password, then press “Log In” to access your Merrick Bank Credit Card.

- If you forgot your e-mail or password, click the “forgot username or password” text link.

- In case you haven’t registered with Merrick Bank. Then click the “Not enrolled? Sign up now” text link.

(It doesn’t matter which card you have; this process applies to both cards.)

About Merrick Bank’s Credit Card:

FDIC (Federal Deposit Insurance Corporation) Merrick Bank has approved the credit card for almost 3 million people.

Two different versions of credit cards are available: Merrick Bank MasterCard Credit Card ( to double the credit line) and Classic Secured Card.

Merrick Bank MasterCard:

This credit card is for those who want to improve or build a good credit score, as it’s convenient to increase your credit or double your Credit line.

You must pay your minimum credit card bill for the first seven months. They will review your account history after the completion of a year, and based on your record, you might be eligible for a double credit line increase.

You can use this card anywhere. Your credit card acceptance is the only term. They’ll report your account to all three major bureaus, so keep your payments consistent to increase your credit score.

Merrick Credit Card additional benefits:

- You can increase your credit line by making consistent payments.

- The bank will report your account to all three major bureaus, which will help you re-establish or improve your credit score.

- You’ll not be responsible for any unauthorized transaction. So you won’t incur additional fees.

- You have various tools for account management, such as making payments, checking remaining balances, and much more.

- You don’t need to hand over any security deposit.

- You’ll get all premium Mastercard benefits.

- You can visit the “Learn” section for any financial concerns and education support for free.

- With paperless statements, you can find all the statements with no worries about keeping them somewhere safe.

- You have the luxury of choosing from 5 color variations for the card. Consider this as an advantage as well.

Crucial points to scrutinize:

- If you don’t pay the fees until the due date, they’ll mark it as a late payment- Hence, you’ll bear additional late fees. So, it’s a good practice to maintain consistent pay-offs and avoid these late fees to improve or increase your credit score.

- As per Federal law, you have the right to get a free copy of your credit report from all three credit bureaus every year, which you can obtain online by visiting www.annualcreditreport.com

Or you can choose to contact each of the bureaus via these phone numbers:

1-800-685-1111 for Equifax

1-800-888-4213 for TransUnion

1-888-397-3742 for Experian

Merrick Bank MasterCard Credit Card Application Process:

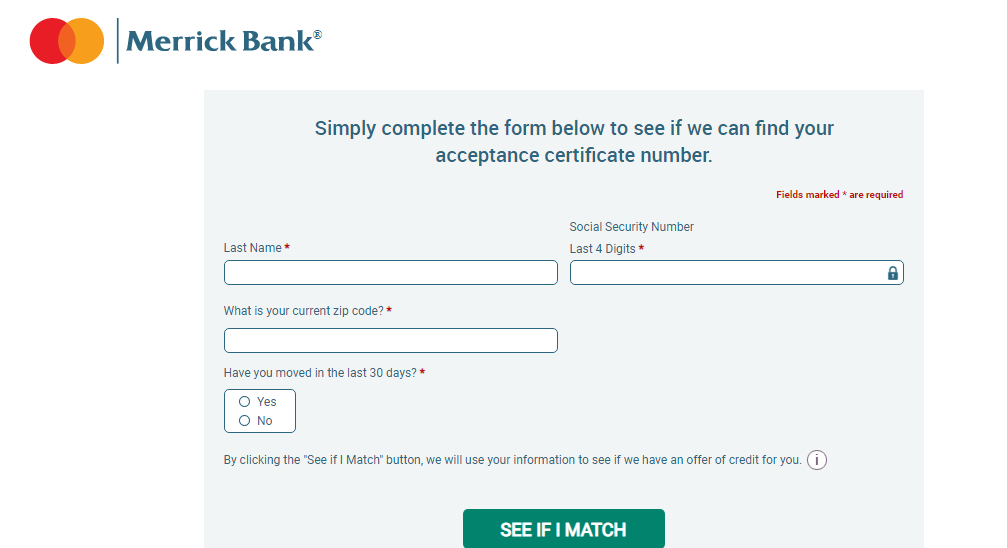

First, you need to get the “acceptance certificate number”. And to do that follow these easy steps:

- Fill out the Merrick Bank Mail Offer form.

- You must give simple details such as Last Name, SSN(Social Security Number), current zip code, etc.

- Hit the green “See If I Match” button, then they’ll see if they have a credit offer for you to give.

- After the review, they’ll send you a confirmation e-mail with a credit acceptance number.

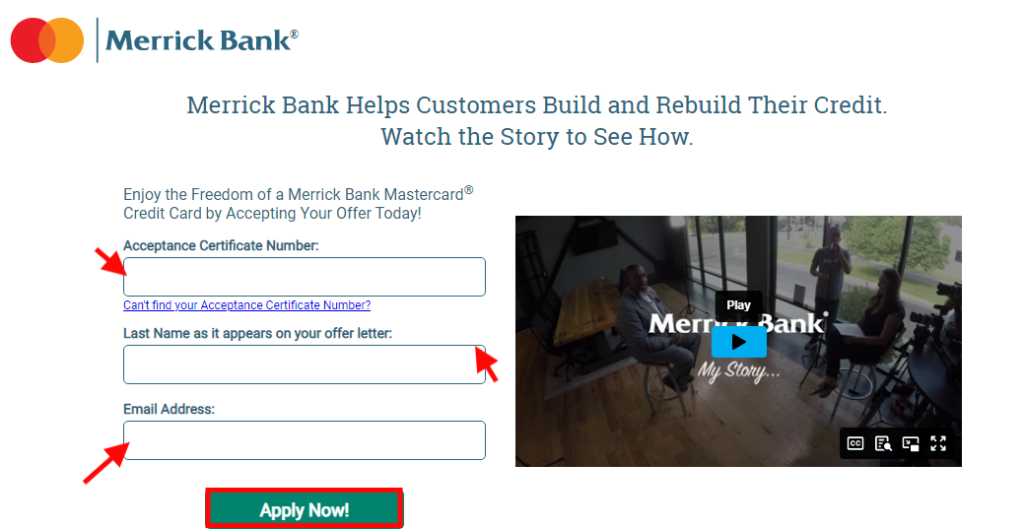

The Process to apply for the card:

- Fill out your Acceptance Certificate Number and Last Name by your offer letter.

- Then hit the “Apply Now” button to apply for the “Merrick Bank MasterCard Credit Card.

Merrick Bank Classic Secured Credit Card:

This one you’ll get on the terms of making a security deposit to determine your credit line. Your security deposit is similar to your primary credit line use, and the primal deposit is between $200 – $3000, which they’ll return in both declination and closure of your account within 20 days.

If you close your account from a secured credit card, please pay your entire credit card bill to get your security deposit back. So, if you want to increase your credit line, then it’ll be good to add more money to your security deposit, which you can’t exceed over $3000.

So let’s look at some important terms for this credit card:

- You must submit a security deposit to be eligible for the card.

- The deadline is 20 days to submit the deposit.

- After you complete your security deposit, they’ll review your application, and within two weeks, this card will be in your hand.

- This card is no different from other credit cards, excluding the submission of a security deposit.

- As mentioned above, you must deposit a security payment within 20 days to participate.

- You can only get one “secured card.” That means you shouldn’t already have a Merrick Bank Secure Card

- It would help to be at least 18 to qualify.

- Be sure to have a verified SSN (Social Security Number).

- You need to have a proper and confirmable residential address in the U.S.

- Not to have a pre-bankruptcy and any debt or tax pending.

- You must be capable of managing all your credits and liabilities.

- You also must fulfill the identity verification for other credit cards.

- The initial APR for purchases and cash advances is 22.70%, which might vary by the market.

- The due period is 25 days; after that, they’ll charge you with interest, which is applied to transactions and not to purchases, which shall not fall below $1.

Benefits of the Secured Credit Card:

This card provides the same benefits as Merrick MasterCard, except the only benefit of getting every month’s FICO score to keep track of your credit score.

The complete guide to apply for the card:

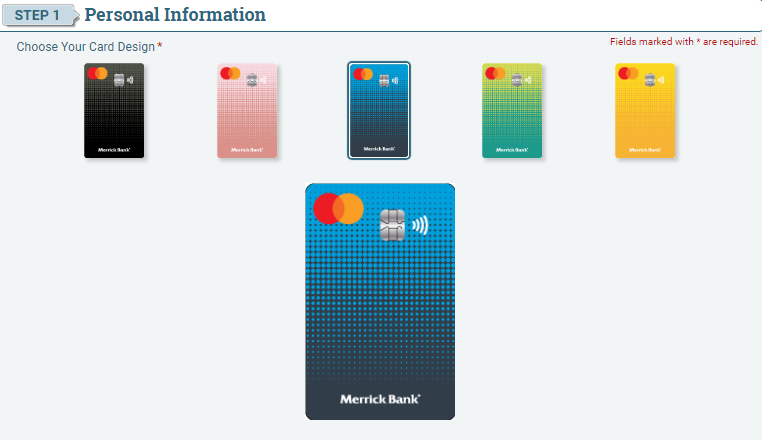

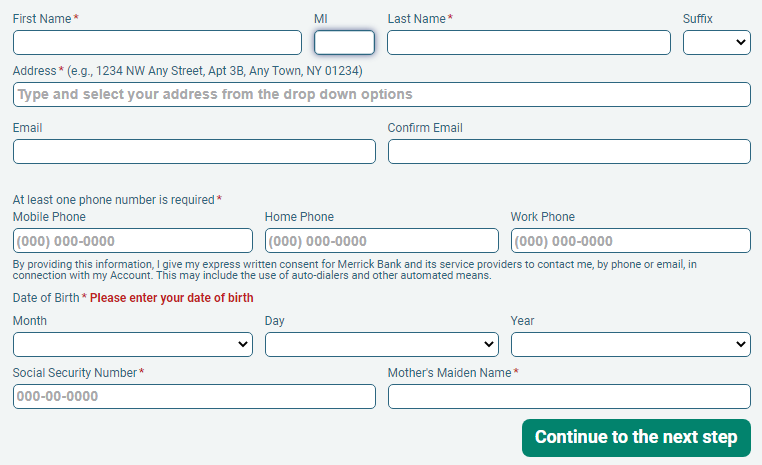

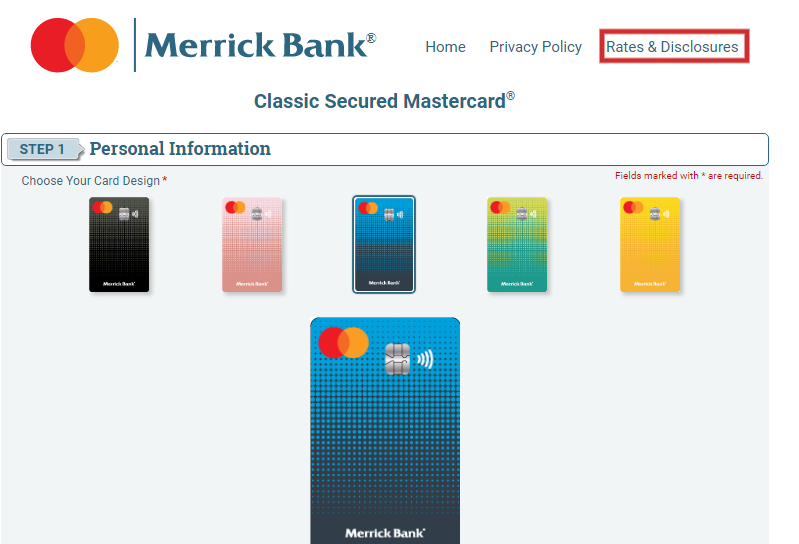

You have 5 steps to go through after visiting the Apply Now for Merrick Bank Secured Credit Card page to get this card, which is mentioned below with some images:

- Step 1: It is an initial step where you first need to pick one of the available varieties of the secured credit card, as the blue one is selected. Scroll down a little to fill out the mandatory required fields (e.g., First Name, Last Name, Address, e-mail, Date of birth, Social Security Number and hit “Continue to Next Step” to proceed.

- Step 2: Fill out your financial details to prove your income and expenses to determine your monetary status, such as income, expenses, employment status, etc.

- Step 3: You must provide an electronic signature to ensure you agree to all the terms, conditions, disclaimers, etc. It’s legally irrevocable, so make sure to read it carefully.

- Step 4: This step is to review the summary of their highlighted terms to help you comprehend the features of this card that we mentioned above. (The benefits of both cards are the same, and you can consider them as the summary of the terms.)

- Step 5: Final step as it stands out, your application will go through the “reviews” process, which would take up to 2 weeks to complete, and if your details meet the standards, then they’ll grant you a secured credit card.

Note: Explore the “Rates and Disclosures” tab highlighted in the image below to review all the crucial points before proceeding.

Different ways to pay your credit card bills:

There are several ways to make convenient, quick, and secure credit card payments, so you don’t have any reason to be late and spoil your credit history.

Here’s a quick look at them:

- You can log in to your Merrick Bank credit card account or through the Go Mobile app and pay your card bills online.

- You can contact them at 1-800-204-5936 and 1-800-253-4563 for TTY/TDD. Their programmed system or agents could help process your payment.

- You also can money order them to the following correspondence addresses with the payment coupon and envelope that they gave you with your statement:

Merrick Bank, P.O. Box 660702

Dallas, TX 75266-0702

Merrick Bank

Attn: Lockbox Operations #660702

2701 East Grauwyler Road, BLDG 1

Irving, TX 75061

- You can also pay via cash using electronic payment methods such as MoneyGram and Western Union by finding a money services desk in retail areas.

Customer Support:

- You can visit the Contact Us page for online support- regarding payments and inquiries.

- You can contact their 24/7 customer support through this number: 1-800-204-5936 (TTY/TTD number: 1-800-253-4563)

Frequently Asked Questions (FAQs)

1. What is a Merrick Bank MasterCard Credit Card?

This credit card is for those who want to improve or build a good credit score, as it’s convenient to increase your credit or double your Credit line.

2. What are the key benefits of using a Merrick Bank Credit Card?

By using this Merrick Credit Card, you’ll get these additional benefits:

- You can increase your credit line by making consistent payments.

- The bank will report your account to all three major bureaus, which will help you re-establish or improve your credit score.

- You’ll not be responsible for any unauthorized transaction. So you won’t incur additional fees.

- You’ll get all premium Mastercard benefits.

- You don’t need to hand over any security deposit.

3, How do I access my Merrick Bank Credit Card?

Merrick Bank Credit Card Login Process:

- Visit the Merrick Bank official site.

- Hit the three-line button for Android users, or hover over the “Log In” button to proceed.

- In the newly opened page, “Credit Card” is selected by default in a drop-down list under the “Customer login” text. So you don’t need to worry about that.

- Fill out your e-mail and password, then press “Log In” to access your Merrick Bank Credit Card.

- If you forgot your e-mail or password, click the “forgot username or password” text link.

(It doesn’t matter which card you have; this process applies to both cards.)

4. How many ways are there to pay my Merrick Bank Credit Card Bill?

Here’s a quick look at them:

- You can log in to your Merrick Bank credit card account or through the Go Mobile app and pay your card bills online.

- You can contact them at 1-800-204-5936 and 1-800-253-4563 for TTY/TDD. Their programmed system or agents could help process your payment.

- You also can money order them to the following correspondence addresses with the payment coupon and envelope that they gave you with your statement:

Merrick Bank, P.O. Box 660702

Dallas, TX 75266-0702

Merrick Bank

Attn: Lockbox Operations #660702

2701 East Grauwyler Road, BLDG 1

Irving, TX 75061

- You can also pay via cash using electronic payment methods such as MoneyGram and Western Union by finding a money services desk in retail areas.

5. What customer support can I get from Merrick Bank?

Customer Support:

- You can visit the “Contact Us” page for online support- regarding payments and inquiries.

- You can contact their 24/7 customer support through this number: 1-800-204-5936 (TTY/TTD number: 1-800-253-4563)