In this era of online money and crypto currency, credit cards are still in trend as 167.2 million U S. people still found using credit cards in mid April 2023 according to Federal Reserve Bank.

As credit cards are a great way to build credit score, earning reward points, and are providing advanced security through disposable card numbers, tap to pay ,etc.

Robinhood gold card which might soon be available on the platform, also provide some additional earning benefits, advanced security and so on.

Below, you will find out everything possible about Robinhood gold credit card.

About Robinhood Gold Credit Card :

X1 credit card (now actually a Robinhood gold credit card) is now owned by Robinhood because the Robinhood Financial Services company took over the X1 Credit card last year.

Robinhood Credit Inc. now provides the service and operates the programs for the card, while its issuer bank is Coastal Community Bank.

This card comes under a Visa license, which means that you can use it across the globe (where Visa card acceptance is available.) with the peace of mind that it’s completely secure for national and international transactions.

This Gold card is available only for those with a Robinhood Gold membership, which costs $50-$75 per annum or $5-$7/month. So, if you are already a member of Robinhood, you can first book your place on the waiting list, and then you can upgrade to a gold membership.

How to Apply:

To this date, there is no actual way to apply for this card as the card is not introduced on the platform yet, however, you can secure your spot for the future, and enroll your name with the others waiting for the card.

So, if you wish to reserve your seat, you can do so with this simple process:

- Visit the Robinhood card official page.

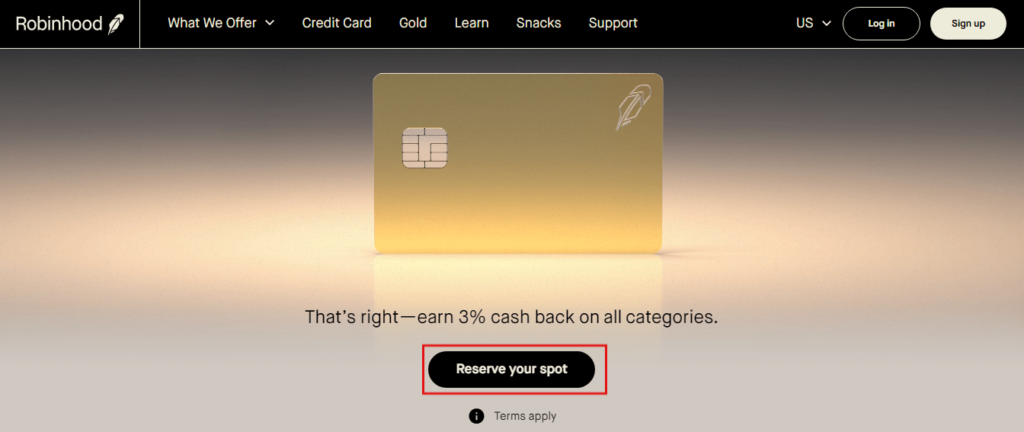

- Click on the “Reserve your spot” button as you see in the image.

- Now just provide your email ID on the newly opened page, and click “Join the waitlist.”

Remarks:

- After you are aboard with the others waiting for the card, you must upgrade to a gold subscription, as they prioritize gold members first.

- If you did the pre-booking for the card online, you must download the Robinhood app to track your waiting status.

- As a gold membership holder, you will get a confirmation e-mail when you are eligible for the card.

What’s the Perks

When the card is released and you enroll on the waitlist, These are the benefits and perks you would apprehend through the Robinhood gold card:

- Completely secure transactions.

- You can request Non-reusable card numbers for confidential purchases and expenses.

- Consistent reporting to all three major bureaus to improve transparency.

- No annual fee or foreign transaction fee is applicable.

- 3% (in the image of 3 points for each dollar) cashback on all eligible services Robinhood provides, without any actual limit.

- Book your travel through the Robinhood travel portal and encash 5% in rewards.

- When you book your flight and under any circumstances, you have to cancel that flight, then you can urge to get a refund.

- You can get additional warranty coverage on all eligible items you purchase through the card.

- Enjoy a 24-hour attendant who will take care of the details from your end when you dine, travel, or do entertainment activities.

- Get rental cover when your rented car is damaged, this benefit eliminates the obligation on the hirer.

- And many more.

Exclusive benefit through referrals:

Amidst your journey to get approval for the Robinhood golden credit card, you can give yourself a chance as Robinhood has crafted a limited-edition golden credit card with 10 Keret gold which is as clean as a whistle by providing 10 referrals from your side. The people you refer should first sign up for the waitlist and then purchase the Robinhood Golden subscription.

After completing these two steps your one referral gets completed, that’s how this works.

Who can apply?

Before applying for a card, it’s good practice to assess its requirements e.g., age factor, credibility, documentation, etc.

So here’s the overview of the most basic requirements to apply for the card:

- You must match the 18 age or above to apply.

- You must have an SSN (Social Security Number.)

- Only permanent U.S. residents can apply for the card.

- People who live in Puerto Rico and within 50 territories of the U.S., can apply for the card.

- You need to maintain a healthy credit score to be able to apply for the card.

Crucial Point to remember:

There are some terms, conditions, and other kinds of stuff that will help you decide whether you even need to follow the waitlist for the card or not:

- The cash advances and balance transfers APR for the card is around 20.24%-29.99%, which might shift in the future.

- The provision of charge for cash advances is $10 or 5% of the amount, they will apply the greater one.

- They will charge you $29 for the first time and $40 after 6 months as for the late payment fee.

- If your bank rejects and returns any applicable payment request, you will be charged $40 as a “returned payment fee.”

- If you request to replace the card, it will cost you $40.

Robinhood Gold Credit Card Alternatives:

If you don’t want to stall needlessly in the waitlist to get priority for the card, which is in itself quite a fact, then you can go to other alternatives, which might give you somewhat similar services.

Sears Shop Your Way Mastercard for instance, which will bring you 5% cashback on gas stations, 3% from grocery store purchases, and dining at restaurants, and that also for the first $10,000 which is not quiet bad. Also it’s pegged with Mastercard license, so that you can use it anywhere without barriers.

If you are someone who likes to shop from a particular retail store or company, and want to earn handsome cashback, then TJX Rewards Credit Card might be a best bet for you, as you earn 10% off for the very first purchase from the card.

Additionally, your each dollar will give you 5 rewards points when purchasing from TJX stores such as TJ Maxx, Marshalls, HomeGoods ,etc.

Contact Support:

There are two ways to reach out to the support team. You can either contact them online through web or Robinhood app just by asking question or picking up a particular topic that nearly matches your question, or through contact support phone number.

- Ask a question online: You can choose a topic which matches your question from the pre-existing sections and start a chat or call with support team.

Just login to your Robinhood account, select the support > contact us 24/7 support from your account tab . Then again select contact us, after that you can choose to chat or call with them. This process works for website and app both.

2. Contact directly through phone: Just call 650-761-7789 to get any kind of information or support.

Frequently Asked Questions

Is the X1 Credit Card worth it?

Because you can get a 3% cash reward, and they haven’t clarified the actual limit of how much you can earn?

Also, the opportunity to get a premium 10 Keret Golden card through referrals, could increase your prestige in front of people. These two facts do make it worth getting one.

However, queuing yourself on the waitlist and buying the golden subscription might be the spoiler terms, and the latter is quite reasonable.

Does X1 Credit Card help build credit?

Along with some great benefits, we must also admit the fact that you already need a fair to excellent credit score to get the card, which the company will verify through the credit bureau reports.

Purchasing the items that are essential, limiting expenses, and making time-to-time payments are the keys that stand out for every credit card like this one.

What’s the minimum income needed?

There is no clarification of how much income is needed, but you need $5-$7 per annum month or $50-$75 per annum to open a Robinhood gold account.

Additionally, you might need to ensure a $2000 minimum balance opening along with opening a margin account.

What’s the credit limit?

They did not specify separately anything that points out about the credit limit, as the card is still yet to be released, however, it relies on your monetary potential, your income/debt, etc.