After receiving a credit card, the first thing you need to deal with is a card activation, which you can’t overlook, since in the current landscape the issuer bank transfers to the person for security reasons.

However, it could be more sophisticated as the issuer gives you many ways to do that, also if it feels troublesome to you, they can help you through a customer assistance number.

We are also going to do the same, as we guide you on how to activate a Credit One Bank Credit Card, and how many ways to do that. So let’s focus on the topic straight away.

And, by the way, we have covered almost everything about Credit Bank Credit Cards, so if you are looking for any information other than the activation process, just scroll down to uncover the information you need.

Here’s how to activate a Credit One Bank credit card:

Activating the card is necessary for purchases, cash advances, and other transactions-related stuff. Follow these steps to activate your card:

Via Website –

- Land on the Activate your card page.

- Enter the card number, including the last 4 digits of your Social Security Number, and tap on “Activate the card.”

Other Way:

If you have issues activating the credit card, just call the 1-877-825-3242 toll-free customer support number to get help.

How to access your credit card online and log in to the account:

First, you need to set up an online account to create login credentials, if you have already done that, then skip this process and scroll down to the log-in process.

Follow this simple process to set up your account:

- Visit the Credit One Bank Sign-In page.

- Click the “Set up online account access” link, located below the Secure log-in button.

- Now, there are three steps where you need to enter essential details to approve your account, if you don’t have an e-mail you have an option to use your phone number instead.

- Complete all the steps to set up your online access account.

Now, that you have completed the account setup or registration process, few steps you can follow to Sign In to your account:

- Visit, the Credit One Bank Sign-In page again.

- Now enter the username and password you created through the “Online access account creation process” just above.

- Now, after clicking the “Secure Sign In” button, you have access to your credit card, make payments, apply for statements, etc.

Credit One Bank:

Don’t get distracted by the name as it’s a financial services company, and is growing briskly as a credit card issuer.

The company so far issues and provides services for almost ten flagship credit cards, covering people with all sorts of credit scores.

Additionally, you can measure yourselves in two contexts: Credit Score, and Rewards, and you can filter that out when you visit their credit cards page conveniently.

The most important thing is that they have 10 cards which you can compare with each other and acknowledge how every card is unique and beneficial in its own way.

Plus, you can look into terms and conditions provided separately for every single card, along with their annual fee, and credit score needed for that particular card. Last but not least you can see the ratings given by satisfied customers which will be a key point to help you with your best pick.

This is convenient as you don’t need to waste your precious time to find out the details you are looking for.

For instance, if you want a card to rebuild your credit, then their best possible guess is a Platinum Visa Card, and for Cash back rewards then one of their best-assorted cards is the Platinum X5 Visa Card.

Credit One Bank’s Credit Cards:

We have categorized some credit cards between the terms “for Rebuilding your Credit Score” and “for Cash Back rewards” which are the qualities most people think resourceful:

Exclusive cards based on credit score:

- When you want to rebuild your credit score, then there are three types of credit cards available that will help you to build your credit score from scratch, as they are available for low credit score holders.

Platinum Visa:

This card brings you some additional benefits such as utilizing it for daily purchases and racking up cash-back rewards except the main purpose which is to help you rebuild your credit score.

So, let’s look at all the benefits you get from this card:

- As it is a Visa card, you can use it anywhere for daily purchases, and get 1% cash rewards.

- The company could increase your credit line, if you pay your credit bills from time to time, and avoid any kind of unauthorized activity, returned payments, etc.

- If you shop from the top retailers in the U.S., you can get 10% rewards on all acceptable purchases.

- You can pay via the card without swiping it, just tap on any chip-enabled terminal, and it will gather all the information, and connect to your bank to complete the payment. That’s quite a secure way to make payments.

- You get a credit score overview every month, along with the convenience of observing the modification in your credit score.

- You can do pretty much everything related to your account after you set up login credentials to make payments, get statements, manage your account, etc. You can manage all that stuff in the palm of your hand, by using the Credit One Bank app.

- You don’t need to worry about any unauthorized transaction since Visa protects you with a zero fraud liability policy.

- You can choose a payment due date according to your suitability.

- There is a range of card designs available, so if any of the available designs match your taste, along with the availability order a card for your closest friend or family member. However, these benefits would charge you some money.

We are providing some crucial terms & conditions for the sake of your knowledge, however, you will find the entire terms & conditions list on the official website:

- The Annual fee is $95 for this card.

- The APR (Annual Percentage Rate) for cash advances, and payments is 29.74% which might vary by market rate.

- If you are charged with interest, it would be a minimum of $1, which will start to be in force after 24 days from the end of each billing period.

- They will charge $10 or 5% (the bigger one is applicable) of the total value of any cash advance transaction.

- Similarly, they charge $1 or 3% (the bigger one is applicable) of the total amount of foreign transactions,

- They charge any late and returned payment with $39 or so.

- The minimum credit line for the respective card is $500.

Secured Card:

A secured card generally needs a security deposit from you, that deposit amount is pretty much your credit limit for the card.

This secured card comes with a Visa license so that you can use this one anywhere too, and this also serves similar benefits as a Platinum Visa card except for some additional ones below:

- You are going to earn some good interest on your security deposit.

- Don’t need to pay an annual fee.

- Get notifications that are helpful and important, and stave off other notifications, as you can set preferences by customizing notifications.

Important terms and conditions for this card, which we want to apprise you of:

- The bank levies $5 or 8% (the bigger one is applicable) of the total value of any cash advance transaction.

- The starting credit line for the respected card is $300, which could increase in line with your comprehensive credibility.

- APR for the respective card is 29.74%.

- The enforceable interest for the card is not beneath $1.

- The penalty fees for late and returned payments are $39.

The other crucial terms and conditions are similar to the “Platinum Visa Card” which we are not mentioning to avoid redundancy.

Vegas Golden Knights Credit Card:

If you are a fan of ice hockey, then you are probably familiar with the six-time Stanley Cup winner “Vegas Golden Knights” team.

This credit card is dedicated to those special Golden Knights fans, so as a fan just keep using the card, and your credit score will improve day by day.

All the Knights cardholders will get these additional benefits, other than “Platinum Visa Card” and “Secured Card.”:

- As it’s crafted for VGK fans, you’ll get high-end deals and exemptions for being a superior Golden Knights fan.

- The most certain benefit is that you can show your support towards VGK by utilizing it in public places so that you will render a good impression towards other people and encourage them to apply one themselves to show support for the VGK team.

Important terms and conditions for VGK credit card, which every VGK fan should acknowledge:

- The annual fee premises on rebuilding, an average and excellent credit term, which means if you have a credit in rebuilding then $75 is applicable, which next year will become $99. While, for average it’s $39, and if you have an excellent credit score, they will not free you with an annual fee.

- The APR for this card is $29.74.

- The fees for cash advances and foreign transactions are similar to “Secured Card” and “Platinum Visa Card” sequentially.’

- The credit line for this card is also $300, similar to a “Secured Card.”

- They charge you $19, in case you request a card for a recognized user.

- Penalty fees are $39.

- Transaction fees for cash advances and abroad transactions are $5 or 8% and $1 or 3%.

Credit Cards premised on handsome cash-back rewards:

However, if you filter out “cash rewards” on the website to pick the card that suits you, there are 9 out of 10 cards available for that, but we are providing the top two credit cards that you can leverage for better rewards:

Platinum X5 Visa:

Unlike the real “platinum”, this card is not that expensive, or credit score needy as there are available that you qualify for if you are even an average credit score holder.

Crucial Benefits:

- First $5,000 you spend through a card to fulfill your TV, internet, gas, grocery, etc. This brings you 5% as a cash reward, any expense after that will give you a 1% reward – this is the plan for every year. So, keep purchasing and keep earning while you can.

- Feel free to purchase, shop, and pay more and more, as you earn 1% cash back non-stop as long as your credit limit allows you.

- Also, you can get a chance to earn 10% cash back on eligible purchases from leading vendors in the U.S.

Vital terms and conditions:

- The credit line for this card is $500, which you can make an increase by showing some promising credit transparency, and time-to-time bill payments.

- The Annual fee, APR is 29.74% while transaction fees for cash advances and abroad transactions are $10 or 5% and $1 or 3% respectively. (They will apply the greater one, which will be either proportionally or monetarily.)

- The annual fee is $95 which they reduce from your final credit limit.

- The interest charge if they apply to your account is $1.

- The penalty fee is $39 for late payments and sent-back payments.

Credit One Bank American Express ® Card:

This card is associated with American Express which is a multinational finance company famous as “Amex.”

This card could bring you these additional exclusive benefits to improve your experience:

- 1% cash back rewards like other Credit One Bank credit cards.

- Entertainment access allows you to purchase tickets for the finest concerts and events.

- Leverage the card to get beneficial deals in travel, hotel stays at cheap prices.

- Amex (American Express)retail protection gives you peace of mind that you can obtain compensation for any blow or theft of your purchased item or goods.

- With the appliance of some crucial terms and conditions, you get travel accidental insurance of up to $150,000 if something bad happens during your travel and you have to bear complete expenses. However, this only includes when you are onboard in the car, train, bus, etc.

- Amex Essentials is the benefit that helps you improve your overall personality by providing some helpful and resourceful tips and tricks such as best travel places, meditation tips for your mental health, etc.

Apart from these benefits, there are some key terms and conditions that apply to the card:

- Its annual fee is $39, as well as the penalty fees.

- Transaction fees for cash advances and abroad transactions are $5 or 8% and $1 or 3% respectively.

- The annual percentage rate for purchases and cash advances is 29.74%.

- The credit line for the Amex card is $300.

Remarks:

- For each card application, one needs to be 18 by age.

- The account that you open when you apply for one of these or remained card is only for your purchases, not for businesses. So be sure to use the card responsibly, and avoid any illegal activity which Federal Bank flagged.

- All the details we provided are as of the first quarter of 2024, and they may modify or change terms in the future, which we will try our best to update.

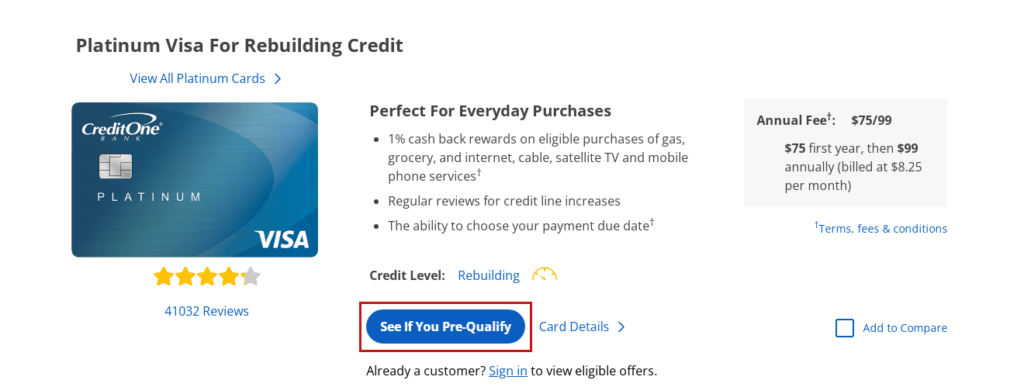

How to check pre-qualification based on credit score:

If you have a particular credit score to qualify for one of their credit cards, then you can check pre-qualification for your desired credit card separately. We’ve elected a “Platinum Visa” for example.

So, now to check eligibility, follow these steps:

- Visit the official of the “Credit One Bank.”

- Now, scroll down a bit to find the “Browse Cards” button, then select your desired card, like we filter out based on “rebuilding credit.”

- Click the “See if you pre-qualify” button to complete an online form.

- Now, you have an application form opened for a Platinum Visa card, where you need to fill out lots of information such as First name, last name, zip code, SSN, etc.

- After that tap on the “See card offers” button. This process will let you know your offer within 60 seconds, without having an impact on your credit score.

Payment Methods:

There are two ways to categorize: Express payment and Standard payment.

While if you choose express payment mode, you have either an option to pay by debit card or bank account, Standard payment provides you only one way, and that is by bank account to pay your bill.

- By MoneyGram or Western Uniton: You can pay using “MoneyGram” or “Western Union” which could cost you some additional charges.

- Send via mail: Mail them with your payment to Credit One Bank, Payment Services, P.O. Box 60500, City of Industry, CA 91716-0500

- Enable AutoPay: You have the option to enable “AutoPay” to avoid any late fees and delays, you need to log in with your credit bank credentials, and you will find it under the menu bar Pay Bill > AutoPay.

- Via eligible payments app: Use Google Pay, Samsung Pay, and Apple Pay, which are described in separate segments in Credit One Bank’s Pay bill FAQs.

Customer Service:

You have the following options to contact customer support.

- For application information requests call 1-800-752-5493.

- Call Customer assistance toll-free number 1-877-825-3242 (TTY/TDD) and for, those farther from the U.S 1-702-405-2042.

- The common correspondence mail address is Credit One Bank, P.O. Box 98873, Las Vegas, NV 89193-8873.